Your access to this website and its associated payment services is governed by the following terms and conditions, as well as the provisions outlined in our privacy policy. By visiting our website, you acknowledge that you have read, understood and agreed to these terms. We may occasionally update our policies and it is your responsibility to check this page for updates.

General Terms and Conditions

These "General Terms and Conditions" are the basic rules for the relationship between MONEYRIVER GROUP INC. (hereinafter "COBBYPAY"), and the customer (called "Client"). These rules cover how business works between the Client and COBBYPAY and are part of the Service Agreements they agree on.

"COBBYPAY" is a trademark owned by MONEYRIVER GROUP INC.

MONEYRIVER GROUP INC. is the proprietor of this website. The services offered on this website are not rendered by MONEYRIVER GROUP INC. All services offered through this website are the products of third parties, each of which possesses appropriate licenses in various jurisdictions.

These General Terms and Conditions shall be applicable in respect of all contractual relations established prior to and continuing on the date of entry into force of the General Terms and Conditions. If the General Terms and Conditions are in conflict with any Service Agreement that can be additionally concluded between COBBYPAY and the Client, the provisions of the Service Agreement shall prevail. The Client confirms that the General Terms and Conditions have been examined and agrees with them and undertakes to follow them at all times.

Before using COBBYPAY's payment services, the Client has to read, understand and accept these rules, COBBYPAY's Privacy Policy, and other agreements that apply to COBBYPAY's services and products.

The Client reserves the right to request a copy of the General Terms and Conditions or Service Agreement at any time by contacting COBBYPAY using the contact details provided or by visiting the website at www.cobbypay.com

Information on the service provider

MONEYRIVER GROUP INC. is a Canadian corporation with Money Service Business authorization.

Our services

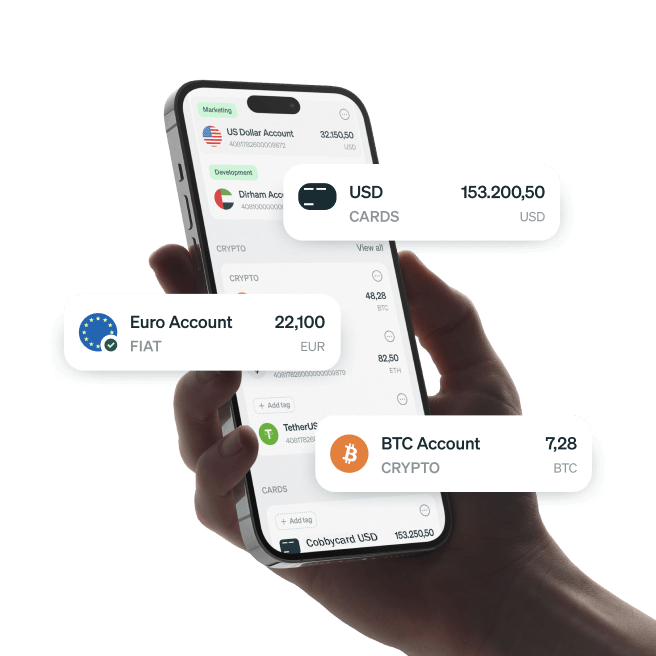

Working with COBBYPAY, clients will get access to the following services:

Opening e-wallets, personal and corporate bank accounts

Domestic and international bank transfers

Foreign exchange transactions

Crypto wallets, crypto exchange and crypto custody

*The Services listed herein shall be rendered exclusively by our duly authorized service providers who possess the requisite licenses and approvals in accordance with the laws and regulations of the relevant jurisdiction. Our duly authorized service providers reserve the right to discontinue their service provision to COBBYPAY in accordance with the terms outlined in the service agreements. Such actions may have an impact on the accounts of COBBYPAY's clients. COBBYPAY accepts no liability for any losses and damages that clients may incur in connection with any disruption of services and/or discontinuation of provided services.

The selection of the service provider for each specific service shall be made in strict adherence to their respective licensing and regulatory requirements.

Client Orders

The Client's orders must be clear and doable. The Client needs to confirm all actions done using their credentials or in the way COBBYPAY asks (like signing a document). This confirmation means the Client agrees to the action taken.

The Client sends orders electronically or in another way they agree with COBBYPAY, using forms provided by COBBYPAY (like logging into the Electronic Channels).

For any payment, the Client must give COBBYPAY accurate, complete, and clear information. COBBYPAY can also ask for more documents to follow the rules and its own procedures. The Client needs to get all necessary permissions and give COBBYPAY the needed documents on time for the payment to be executed.

COBBYPAY shall allow the Client to make payments only if the people authorized by the Client are identified as per COBBYPAY's records, follow the signature rules, and the transaction limits set for the Client at that time.

COBBYPAY can change payment limits, deadlines, exchange rates, or interest rates without warning, and the changes apply right away in the Electronic Channels.

The limits of amounts for execution of Payment Operations set by COBBYPAY, the cut-off times, the exchange rate or interest rate used by COBBYPAY shall be subject to change without prior notice and shall be immediately applied and made available in the Electronic Channels.

The Client has to follow COBBYPAY's security guidelines for protecting their Payment Accounts. COBBYPAY won't be responsible for any losses or damages if the client does not follow the security guidelines published by COBBYPAY. If the Client uses its Payment Account via Third Party Services (e.g. e-wallets) the Client must follow the security guidelines applicable to Third Party Service.

Transactions involving cryptocurrencies may not be executed in real time due to compliance procedures and reliance on third-party providers. The exchange rate applied to a cryptocurrency transaction will be the rate prevalent on the execution date of the order. We and our affiliates shall not assume any liability for losses incurred if the cryptocurrency transaction is executed at a less favorable exchange rate than the rate on the day of the order. The Client acknowledges the inherent volatility of cryptocurrency markets and understand that exchange rates may fluctuate between the order placement and execution and the client remains responsible for staying informed about cryptocurrency market conditions and the Client shall understand that exchange rates may vary between the order placement and execution. We do not guarantee a specific exchange rate for cryptocurrency transactions, and any information provided about rates is indicative and subject to change. The execution date, for the purpose of determining the exchange rate, is the date on which the cryptocurrency transaction is successfully processed and confirmed by us. By engaging in cryptocurrency transactions on our platform, the Client acknowledge and accept the terms outlined in this clause regarding transaction processing time and exchange rate determination. We reserve the right to amend the terms of this clause without prior notice to the Clients. Continued use of our services implies acceptance of any such amendmentsBy utilizing our services for cryptocurrency transactions, the Clients expressly agree to the terms outlined . in this Cryptocurrency Transaction Processing and Exchange Rate Clause.

Restrictions on use of services

COBBYPAY may choose not to carry out a Payment Order if there's a suspicion that the Client didn't authorize it properly or that the Client's security procedures were violated, infringed and / or the Security Elements of the Payment instrument used were lost / stolen / disclosed to unauthorized persons / inadequately used.

COBBYPAY shall initiate any verification action in this respect, subject to the applicable legislation in the field. COBBYPAY will only suspend its services upon a third party's request when mandated by legal provisions and according to the prescribed procedure. COBBYPAY will reinstate the services upon receiving an official resolution from the relevant authority or a valid court decision.

COBBYPAY shall have the right to block the Service if:

COBBYPAY suspects the Client of money laundering, terrorist financing or other crime or illegal activity (e.g. fraud);

the Client has not submitted data or documents requested by COBBYPAY in due time;

COBBYPAY has become aware of any circumstances which have caused the necessity to examine the legal origin of the Client’s funds or assets;

COBBYPAY is notified of the Client’s death;

according to COBBYPAY’s opinion, freezing of an account is necessary in order to prevent damage to the Client, COBBYPAY or a third person;

there is suspicion that the Client’s Credentials have been used without the Client’s consent or these are stolen;

there is suspicion that the Client’s Credentials have been used to commit fraud.

COBBYPAY will notify the Client when it rightfully declines to carry out a Payment Order. If feasible and not restricted by the law, COBBYPAY will also provide the reasons and potential solutions. It's important to note that COBBYPAY won't be held responsible for any outcomes resulting from the non-execution of a Payment Order due to the circumstances mentioned above. Additionally, COBBYPAY cannot be held accountable for any harm caused by the blocking of the Client's Payment Account.

Prohibited Jurisdictions

COBBYPAY will not curry any transactions to and from the following jurisdictions:

Afghanistan, Albania, Belarus, Botswana, Burundi, Cambodia, Central African Rep, Chad, Congo the Democratic Republic, Cuba, Djibouti, Equatorial Guinea, Eritrea, Gaza Strip, Ghana, Guinea Bissau, Iran Haiti, Islamic Republic of Iraq, Lao People's Democratic Republic, Lebanon, Liberia, Libya, Mali, Mauritius, Mongolia, Myanmar, Nicaragua, North Korea, Russian Federation, Somalia, South Sudan, Sudan, Syria, Trinidad & Tobago, Uganda, Ukrainian territories of Crimea, Donetsk, Luhansk, Vanuatu, Venezuela, Yemen and Zimbabwe.

We reserve our rights to reject any transaction from or to a jurisdiction not explicitly specified in the current list.

Prohibited Businesses and Prohibited Business Activities

COBBYPAY will not curry any transactions to and from the below types of business and any transactions related to the below business activities:

Sanctioned individuals and entities,

Businesses registered in Extra High-Risk countries (prohibited Jurisdictions),

Unlawful business (e.g. illegal business or when license or special permission is required and such is not in place),

Companies whose nature, structure or relationship make it difficult to identify the ultimate beneficial owner(s) of significant or controlling interests, including clients that are corporations with the ability to issue bearer shares,

Business activities related to violent or obscene content production;

Business activities related to arms, weapons and other military products and services;

Anonymous or numbered account providers;

Cultural heritage, artifacts, antiques, or art dealers;

Financial services businesses that accept cash settlement or provide physical cash management services;

Human organs dealers and the like;

Lottery organisations;

Non-governmental charities and religious organisations;

Pyramid scheme type operations

Sellers, producers, or distributors of any material that incites discrimination, sedition, or other offensive material;

Shell banks or shell companies; and

Any activity that requires licensing from a domestic regulator where the customer is unlicensed including, without limitation, unlicensed financial institutions, company service providers, law firms, accounting firms, loans companies, real estate services providers and so on.

Crypto-currency mixing activities

Business activities related to nuclear material and nuclear power

Prostitution / escort

Unregulated casinos or gambling activities

We reserve our rights to decline any transactions involving businesses or activities not explicitly specified in the current list.

Security and Fraud Protection

The Client is responsible for safeguarding the Security Elements associated with electronic Payment instruments used for conducting transactions. To ensure their security and prevent fraud or unauthorized use, the Client must take all necessary precautions, to safeguard the security elements. Any consequences arising from the Client's improper use of communication and data transfer methods or electronic Payment Operations will be entirely the Client's responsibility and at their own risk.

COBBYPAY strongly advises Clients to take reasonable precautions in ensuring the security of their Payment instruments, tools, and devices used for making payments. This includes the following practices:

Creating robust and secure passwords.

Safeguarding passwords and credentials by using Password Managers or other secure storage methods.

Avoiding the sharing of login and authorization credentials with others.

Recommending the use of team member access and permissions to grant access and issuing individual credentials for any other authorized users of Payment instruments.

Clients should refrain from actions that could enable unauthorized access to payment tools, such as:

Writing down credentials in an easily noticeable manner.

Granting access to devices where credentials are stored or easily accessible.

Periodically, COBBYPAY will communicate with Clients to provide reminders and advice on how to enhance the security of their accounts. The Client is required to promptly inform COBBYPAY in the event they discover the loss, theft of their Security Elements, unauthorized use of their Payment instrument, or any other unauthorized transactions on their account. This notification should be made through the contact options provided by COBBYPAY. Until COBBYPAY receives this notification, the Client will be held fully responsible and will be responsible for any losses or damages incurred due to unauthorized Payment Operations resulting from any of the mentioned situations. Upon receiving notification from the Client and in situations where there are valid security concerns related to the Payment instrument or suspicion of unauthorized or fraudulent use, COBBYPAY will take the necessary action to block the Payment instrument. During this period, COBBYPAY will not be held responsible for any losses incurred by the Client due to inappropriate use of the instrument.

This responsibility lies with the Client until the notification is received by COBBYPAY or until COBBYPAY takes action to block the Payment instrument based on its decision.

The Client will be responsible for any losses stemming from unauthorized Payment Operations resulting from the use of a lost or stolen Payment instrument, as well as losses arising from unauthorized use of the Payment instrument in cases where the personalized Security Elements were not kept secure, up until the moment when the notification is made.

COBBYPAY will promptly inform the Client if there is suspicion of fraud, actual fraud, or if there are security threats related to a service and/or Payment Instrument, following its internal procedures. COBBYPAY will also inform the Client about the reasons for blocking a Payment Instrument unless disclosing such information would jeopardize legitimate security concerns or is prohibited by other applicable legal regulations. As per legal requirements, COBBYPAY may employ various communication methods to notify the Client in the event of any payment service becoming unavailable.

COBBYPAY employs the latest online security measures to ensure the protection of the Customer's personal information and privacy. These measures include, but are not limited to, the following:

1. Identity Confirmation: COBBYPAY will request the Client to confirm their identity using current security procedures. This may involve providing specific information (e.g., answers to security questions), partial digits of certain passcodes, or codes generated through Two-Factor Authentication, known only to the Client.

2. Secure Electronic Channels: COBBYPAY makes every effort to ensure the security of Electronic Channels. This includes keeping records of all online messages, instructions, or transactions conducted through these channels, along with timestamps.

3. Encryption: All COBBYPAY websites are encrypted.

4. Two-Factor Authentication: Depending on the type of Electronic Channels used, users have an option to activate authentication using Two-Factor Authentication. If you receive an authentication code without initiating an action, it's important to contact COBBYPAY promptly.

5. Malware and Phishing Protection: COBBYPAY employs systems to detect potential malware or phishing attacks, safeguarding Client accounts. Fraud-detection systems are also in place to identify unusual transactions and prevent fraud, money laundering, and illicit activities.

6. Compliance with Regulations: COBBYPAY is obliged to adhere to any restrictions imposed by the UK Government or the international community concerning the provision of payment and banking services to individuals or organizations listed under relevant sanctions or embargoes. This may entail COBBYPAY investigating or monitoring payments to and from the Client's account. COBBYPAY may also need to investigate the source of funds or the intended recipient, which could lead to delays in processing payment instructions or receiving cleared funds. Whenever possible and when not prohibited by the law, COBBYPAY will communicate the reasons for the delay and provide an estimated duration.

Limits on and restrictions of use of Services

COBBYPAY has the right to establish limits on specific transactions and, if necessary, discontinue certain services provided to clients. These actions may be taken if there is a change in the client's risk profile or for any other reasonable cause, without the obligation to disclose to the client such reason or to provide prior notification to the client. COBBYPAY shall assume no liability for any damage that the client may suffer from such actions.

The Client has the right to request increase of the limitations established by COBBYPAY to the extent and pursuant to the terms and procedures established by COBBYPAY.

Prevention of money laundering and terrorism financing

COBBYPAY consistently adheres to its Know-Your-Customer (KYC) principles when establishing and maintaining a business relationship with the Client. According to these principles, the Client's identity must be verified, and the suitability of transactions must be evaluated based on the Client's primary business and historical transaction patterns.

COBBYPAY reserves the right to request additional information, such as documents supporting specific transactions, from the Client to fulfill its obligations in preventing money laundering. This additional information may encompass details about the Client's ownership and ultimate beneficiaries, business activities, contractual partners, transaction volume, the proportion of cash versus non-cash transactions, transaction frequency, and more.

The Client agrees to promptly provide all necessary information and documents requested by COBBYPAY, without undue delay, to comply with these requirements. If the Client fails to submit the requested documents and relevant information, irrespective of previous requests, COBBYPAY may consider it a significant breach of the Service Agreement. Consequently, COBBYPAY may terminate the Service Agreement and any other agreements forming the basis of the business relationship without prior notification.

To adhere to Anti-Money Laundering (AML) legislation, COBBYPAY will retain all documents, including the Client's personal data and account information, for a period of five years following the termination of services provided by COBBYPAY.

Restricted activities

While using the Electronic Channels or the Services, or during any interactions with COBBYPAY, the following activities are strictly prohibited:

1. Utilizing the Services for illegal products or services, as well as stolen items, including digital and virtual goods.

2. Engaging in transactions with parties subject to sanctions.

3. Any action or inaction that breaches any law, statute, ordinance, regulation, or good faith.

4. Any action or inaction that violates the terms and conditions established by COBBYPAY.

Product and Service fees

COBBYPAY shall have the right to receive and the Client shall be obliged to pay for the rendered Service fees, established in the General Terms and Conditions. The pricing of services will be communicated and mutually agreed with the client subsequent to the approval of the client's application by the compliance department. We retain the right to unilaterally modify the Pricing, including altering the amount, frequency, or time frames for the payment of any fees and/or charges associated with the provided services. COBBYPAY will provide the Client with notification of these changes at least 5 (five) Business Days prior to the implementation of the new or amended Pricing. Any applicable fees owed by the Client will be deducted from the account balance. TheClient shall be obliged to keep a sufficient amount of money on the Payment Account so that COBBYPAY can debit the Payment Account with all service fees and other sums and arrears payable. If Payment Account as a consequence of any action undertaken by the Client has a negative balance, the Client shall immediately without requirement of any notification from the side of COBBYPAY correct such balance, so it would be more or equal to zero. COBBYPAY may send notifications or take any other reasonable actions to recover such negative balance from the Client, including but not limited to employing debt collection services or instituting a legal action. COBBYPAY may charge the Client for reasonable costs incurred subsequently to any measures undertaken in this respect. All of the fees are non-refundable and all the fees payable to COBBYPAY are in EUR.

The fee structure for our Services may vary among our clientele. The fee schedule is designed for each client individually and it is tailored to their needs, and their risk profile.

Termination of the business relationship

The Client has the option to terminate the business relationship at any time by providing notice to COBBYPAY.

COBBYPAY also has the right to terminate the business relationship with two(2) months' notice for its convenience.

Furthermore, COBBYPAY may terminate the business relationship and this agreement with immediate effect, without specifying the reason, in the following circumstances:

When COBBYPAY suspects the Client of being involved in money laundering or terrorist financing.

If the Client submits incorrect, misleading, or insufficient information or documents to COBBYPAY or refuses to provide requested information or documents in a timely manner.

If COBBYPAY suspects the Client of engaging in restricted, prohibited, or other illegal activities while using the Services.

When the Client intentionally or due to negligence fails to fulfill obligations outlined in this General Terms and Conditions.

If COBBYPAY is legally obligated or directed to terminate the relationship by any competent court, governmental authority, public agency, or law enforcement agency.

If the Client has not utilized the Payment Account (i.e., initiated payment transactions) for 180 consecutive calendar days.

Suspending the use of Services

COBBYPAY reserves the right to change, suspend or discontinue any aspect of the Services at any time, including, but not limited to hours of operation or availability, Third Party Services, or any feature, without any notice and not subject to any liability. Where it is possible COBBYPAY shall notify Client in a timely manner regarding such change, suspension or discontinuance of any aspect of Services.

Responsibility for loss or damage

COBBYPAY is accountable for any loss or damage suffered by the Client that is a foreseeable consequence of COBBYPAY violating these General Terms and Conditions. However, COBBYPAY will not be held responsible for losses or damages that were not foreseeable. In the context of these General Terms and Conditions, foreseeable losses or damages refer to those that were clearly expected to occur as a result of actions or negligence.

COBBYPAY cannot be held responsible for its inability to provide services or delays caused by factors beyond its control.

COBBYPAY will not be held liable for any disruptions in service provision that occur as a result of COBBYPAY fulfilling its legal obligations.

If the Client uses COBBYPAY's services for commercial or business purposes, COBBYPAY will not be liable to the Client for any loss of profit, anticipated savings, damage to reputation, business interruption, or missed business opportunities.

In the event of an unauthorized payment or an error caused by COBBYPAY, upon the Client's request, COBBYPAY will promptly refund the payment amount, including any fees deducted. However, this refund does not apply in the following situations:

If the Client engaged in fraudulent activity, in which case COBBYPAY will not issue any refunds, and the Client will bear full responsibility for all losses.

If the Client failed to promptly notify COBBYPAY of security issues with the Payment Account (e.g., loss of a Payment Instrument), the Client will be accountable for any losses incurred up to the time of notification.

In cases where the payment was unauthorized, but the Client, whether intentionally or through gross negligence, compromised the security of the Payment Account or failed to adhere to obligations outlined in these General Terms and Conditions.

If the Client did not report an unauthorized or incorrectly completed transaction to COBBYPAY within 2 months from the date of the event. In such instances, the Client will solely bear responsibility for any losses.

The Client is responsible for regularly monitoring their Payment Account and promptly informing COBBYPAY of any unauthorized transactions, discrepancies, or concerns.

COBBYPAY disclaims any responsibility for the content of third-party websites linked to or from COBBYPAY's webpage, and it shall not be held liable for any loss or damage that may result from their use.

COBBYPAY shall not be held accountable for any loss or damage resulting from malware, viruses, or other technological attacks or harmful materials that may infect the Client's computer equipment, software, mobile devices, data, or proprietary materials used in connection with COBBYPAY's services.

The Client is responsible for compliance with these General Terms and Conditions, applicable laws, and regulations. In the event of losses, claims, damages, costs, or expenses arising from a breach of these General Terms and Conditions, applicable laws or regulations, or the use of services, the Client agrees to indemnify and hold COBBYPAY harmless.

If the Client identifies an unauthorized or incorrectly executed Payment Operation, they must notify COBBYPAY promptly for correction, within a maximum of 2 (two) months from the date of processing of the respective Payment Operation.

COBBYPAY is liable only in cases of gross negligence or intentional violation of its obligations, and its liability is limited to the actual direct loss incurred by the Client as a result of the non-execution of the Payment Operation.

No warranty

COBBYPAY's Services are offered on an "as is," "as available" basis, and without any express, implied, or statutory representations or warranties. COBBYPAY does not guarantee uninterrupted or error-free Services, except where such guarantees are mandated by law.

COBBYPAY is not a banking institution therefor no deposit guarantee scheme applies to the accounts opened within COBBYPAY. However, COBBYPAY ensures that Clients’ funds are kept safe for the benefit of COBBYPAY’s Clients.

Severability

Each section, clause, and provision of these General Terms and Conditions operates independently. If any section, clause, or provision violates the laws of any country, state, province, sovereignty, or government where these General Terms and Conditions are in effect, it shall be considered separable in that jurisdiction and shall not impact the validity of any other section, clause, or provision herein. If a court or relevant authority determines that any section, clause, or provision is in violation, the remaining clauses, sections, and paragraphs will continue to be fully effective, preserving their intended rights and obligations.

Settlement of complaints

The Client may submit a complaint, in regards to any of the products, services or actions of COBBYPAY directly to COBBYPAY by email to: support@COBBYPAY.com

Final provisions

If any provision or part of these General Terms is determined to be invalid, unlawful, or unenforceable by a court of competent jurisdiction, the remaining provisions shall continue to be valid and binding on the Parties.

Any dispute or claim arising out of or in connection with these General Terms shall be governed by and construed in accordance with the laws of the England and Wales. The Parties agree to submit to the exclusive jurisdiction of the courts of the England and Wales.

However, in the event that the law of the jurisdiction of the third-party service provider prohibits such governance, these terms shall be subject to the laws of the jurisdiction of the third-party provider.

Cross-border transfers at a reasonable cost and high speed. Any type of client will be able to find a suitable solution with us.

Get started